Some Real World Examples where Standard Pricing Fails

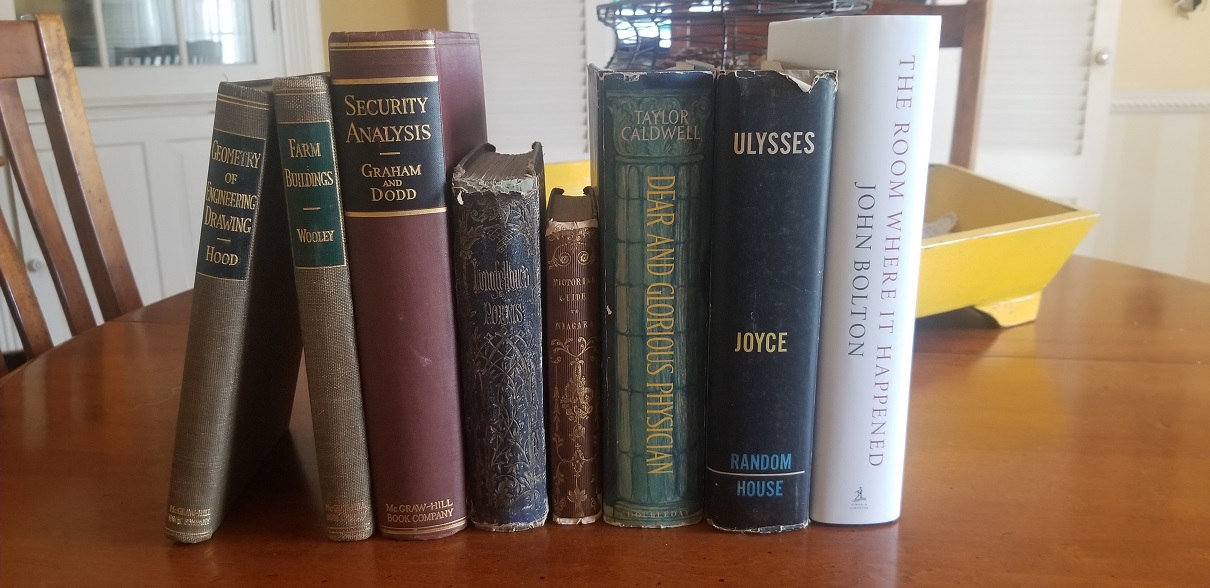

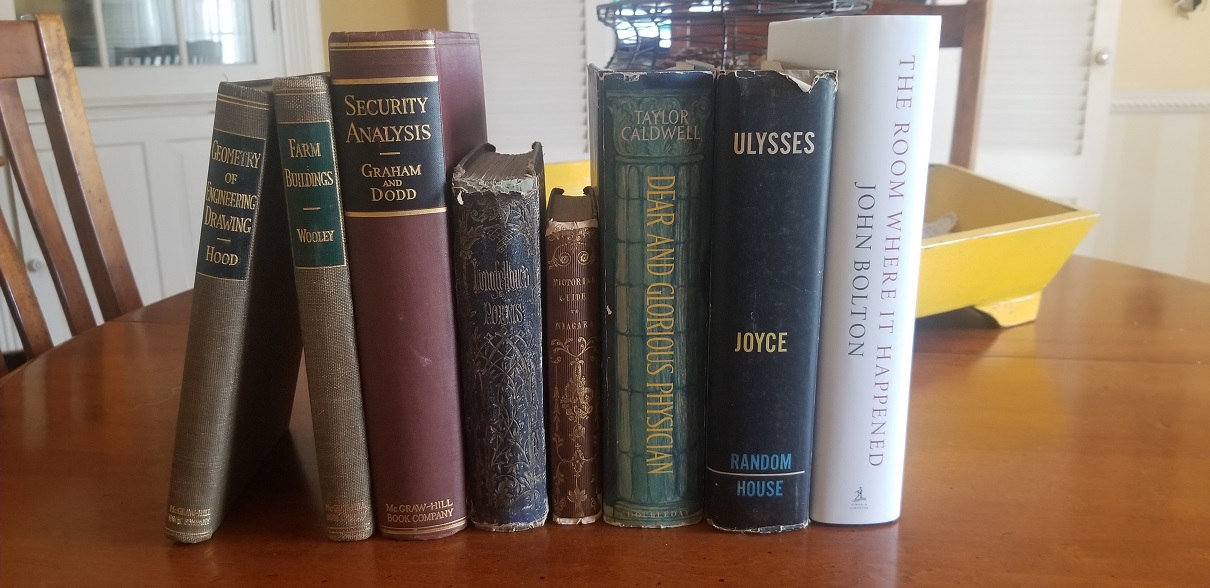

The picture above is typical for many estate sales. A large home might have 5 or 6 bookshelves full of books. If you're running this sale, you may just put up a '$2' hardcover for the first day, and leave it at that. Problem is, the owner has said, 'I think my dad had some valuable books, but I don't know where they are'. You can't go through each book, there's just not time. You can put a '$5' sign for the first day, but that's above the price that people will just make a pile. And to get rid of a quantity, that's what you need, piles of books going out the door, in the next 48 hours.

Let's take a closer look... 8 books, where's the value?

Looking at our 8 books, the one to the far right might jump out as the most valuable. You recognize it as a new book, one that people are currently paying almost $30 for at a bookstore. You pull it out, and put a $5 sticker on it. You pat yourself on the back, and say 'job well done'. The rest can go at $2. Right?

'Standard Pricing' nets you $13 ($5 for Bolton, $2 for 4 others)

Actually,the four books in the middle are valued at over $10,000, all purchased at local sales for $2 or less

Can you see which one is the most valuable?

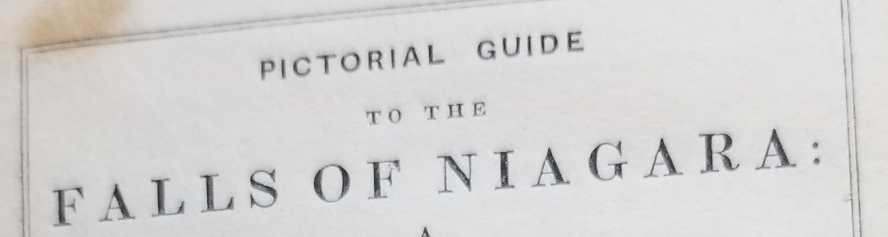

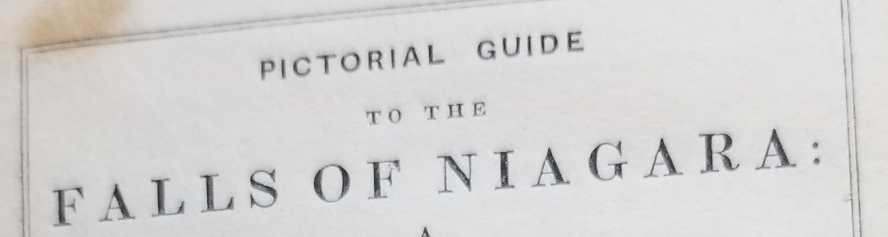

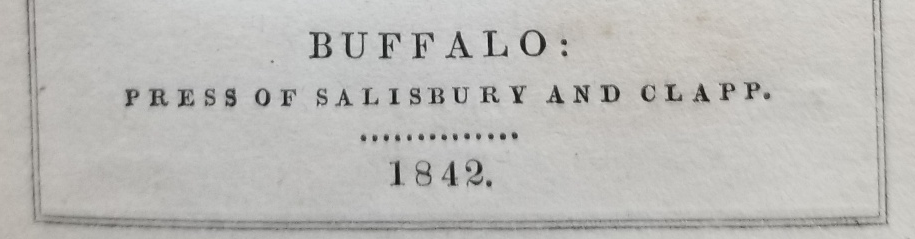

A serious collector will reach for that small brown one, in the middle. What does she find?

This is one of the first 'souvenir' pieces produced in the United States. It contains early pictures and maps of Niagara Falls.

Any collector would consider this to be a nice find. It has collectible value on a number of fronts (one of the seven wonders of the world, maps, early engravings, etc.) Only 1 or 2 online for sale, a book easily worth $200 to $300.

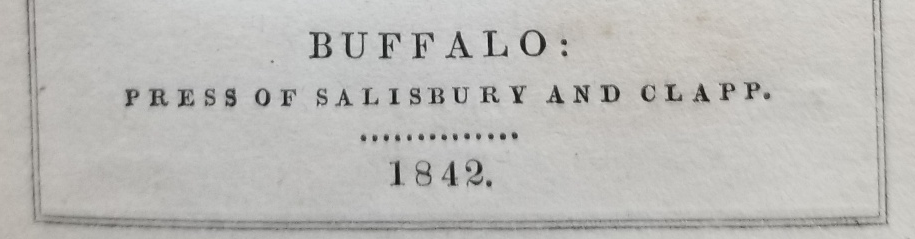

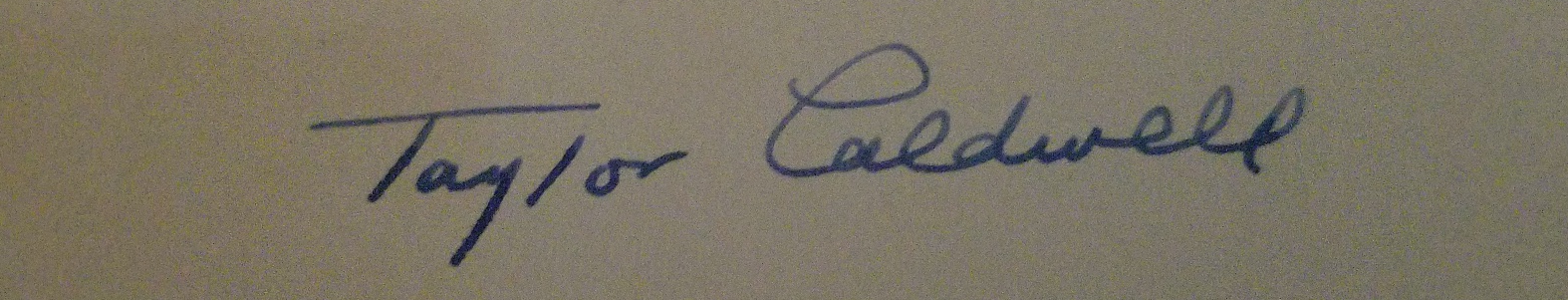

What about 'Dear and Glorious Physician?'

Let's pull it off the shelf. We look at the page just following the title page, and see the words every collector wants to see, "First Edition". That's enough to make this book a buy. But lets look a bit closer, you see it looks like the owner has signed the book. Look again, that's actually the author's signature.

This is an obvious buy, especially at $2. Online, the book will sell for over $500. It's actually hard to value exactly, because Caldwell signed very few books.

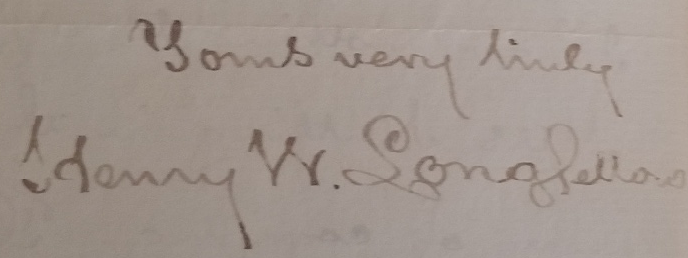

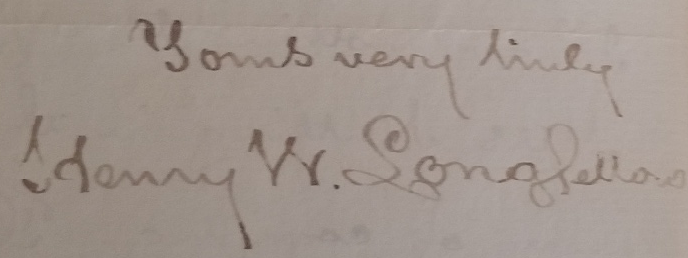

What about the Longfellow book?

There's a nice surprise when we open the Longfellow book. Tucked carefully inside is a handwritten note, signed by Longfellow.

The rare book, and the even greater find of the hand written note, make this the kind of thing that creates early morning lines at sales. At auction, the value might approach $800 for the note and book combined.

So what's the most valuable book?

Even a seasoned book collector might miss this one. It's one of the 3 text books. Two of the text books probably wouldn't sell for $1, but the other one, conservatively, will bring in $7000.

In 1934, Benjamin Graham taught at Harvard. Security Analysis, pictured here, is the first edition of that book (the number of the printing impacts value). Benjamin Graham's most famous student is Warren Buffet. Investment houses on Wall Street will proudly display this book, and pay dearly to do so.

NO! You won't find books like these very often

but it is finds like these that cause people to wake up at 4AM (or earlier) to go to your sales

We've established two things:

- Pricing that empties a large house in 2 or 3 days will lead to some valuable items being sold too inexpensively.

- It's not possible for anyone estate company to have a level of expertise that matches the combined expertise of those coming to a sale.

- Experts in various items are attending your sales and taking advantage of this.

Lets look at how Google, or Airbnb would handle this

An old school newpaper would sell you an ad based on the dimensions of the ad. 3 inches by 5 inches, $200, or whatever was appropriate based on the circulation of the newspaper. This is somewhat similar to estate sale pricing now. One price, that being the lowest to clear out the most inventory.

Google changed that, and we can learn from it

Google does not set a price for it's advertising space. They realize, they don't know best, and can't possibly try to figure out how much to charge for the millions of different things people may want to advertise. This is very similar to the position you are in, when pricing for an estate sale.

Google lets the 'experts' set a price, based on an auction

A law office may believe it would be profitable to represent mesothelioma victims in court. They need to find these people, so they turn to Google. Google doesn't know anything about how profitable these lawsuits might be, so they can't set a price for the ad. Google decided, let the law offices bid for the opportunity for us to put those ads in front of people that are searching for 'mesothelioma'.

Airbnb does something similar, detecting booking demand in an area for a given date, they begin to raise prices in that area for that date. Airbnb can't track every event in every area that might drive up demand, but they let the experts, in this case the people doing the searching, set the price.

The solution to Estate Sale Pricing

Two Part Pricing

Two part pricing allows a business to extract more money from some customers than a single price will allow. Similar to an amusement park that charges an admission fee, and additional fee for some rides, that is how we will handle early admission to your sale.

Let's return to the book example

You are fairly certain that most of the books in the house are not that valuable. You'll sell the most books if you have a base price of $2 at the start, and the drop by a third, and one half, as the sale progresses.

You take pictures of the books, and post them online. Let's say in this sale we have some furniture, glassware, books, and some jewlery that have value.

You may have two book buyers that recognize the 'Securities' book. Similar to the Google ad sale, these experts will bid against each other, driving up the gross sales for your sale, without you doing any additional work. You've also kept the price low on the other books, so you'll keep a high number of sales.

An Old School Farm Auction trick, and how you benefit

Most onsite auctions, especially those held outside, will place ten or more boxes filled with items, on top of a table. The auctioneer will call out 'buyers choice', and the auction begins. Tucked in each box is something of value. The problem for the bidder, you don't know what box the other bidders are looking at. The high bidder gets to choose which box they'll take. It may, or may not be the box you were hoping to get, so you bid again, hoping to get your box.

In this 'farm auction' example, it pits experts in different categories against each other. A small piece of jewelry in box 2, and an envelope in box 6 with a valuable stamp, will pit these two bidders against each other, driving up the value of both boxes, even though both bidders want different items.

In our book example, you only need one person to recognize the value of the Graham book

Because your bidders are bidding on entry to the entire sale, not just the 'book room', they will bid against all other buyers.

In this case, let's say one buyer has recognized a valuable watch. The book buyer, and the watch buyer will bid against each other, because they don't know what the other person will purchase once inside the sale.